Posts tagged freelance

Biden Wants To Restrict Work and Flexibility for Freelancers

February 20, 2023 // Beyond these misunderstandings, there is a key question that PRO Act proponents have failed to directly answer: Over a dozen surveys—including the Bureau of Labor Statistics' Contingent Worker Supplement—have found that a majority of independent contractors would prefer their current arrangements over an employment arrangement. Workers cite dependent care obligations, personal circumstances, or a strong preference for job flexibility (over job stability) as the primary reasons. Beyond surveys, in a recent study published by the Journal of Political Economy, economists estimated that UberX drivers would require almost twice as much pay to accept the inflexibility that comes from adopting a taxi-style schedule. And for the top 10 percent of DoorDash drivers, losing flexibility is equivalent to a 15 percent pay cut. Sens. Mark Warner (D–Va.), Todd Young (R–Ind.), and Rep. Suzan DelBene (D–Wash.)

A third of Americans contribute to the $1.3T freelance economy. Now what?

January 24, 2023 // Nearly 40% of Americans performed freelance work in 2022. That’s up nearly 10% from 2021, and a third of them make freelance their full-time work.

How To Empower Millions of Independent Workers

January 3, 2023 // Given millions of Americans' clear preference for independent work, and given the economic benefits of these arrangements, state and federal legislators should reduce the regulatory and tax burdens on both independent workers and gig platforms.

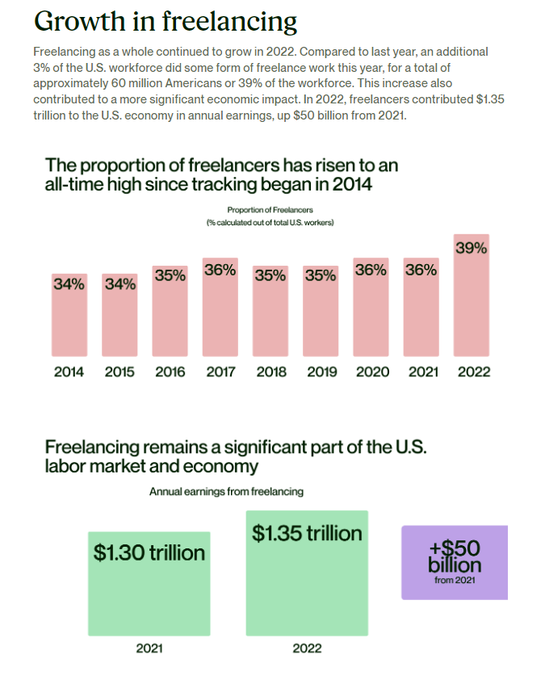

Freelance Forward 2022

December 29, 2022 // Upwork's 2022 Freelance Forward survey, a representative study of 3,000 professionals, reveals a staggering 39% of the U.S. workforce, or 60 million Americans, performed freelance work in the past year, an increase from the year prior. At a time of economic and labor market uncertainty, Upwork’s study found American freelancers contributed approximately $1.35 trillion in annual earnings to the U.S. economy, $50 billion more than in 2021. This growth was driven in large part to professionals seeking alternatives to the traditional model of a full time, 9-to-5 job. The data shows that increasingly, professionals are exploring the benefits of freelancing, whether for extra income, autonomy or as a way to find more meaningful work.

Sens. Braun, Burr, Thune, and Rep. Foxx Lead Republican Colleagues in Urging Department of Labor to Protect Independent Contractor Classification

December 19, 2022 // Senators Braun, Burr and Thune are leading a bicameral letter with Rep. Foxx (R-N.C.) urging the Department of Labor (DOL) not to move forward with its proposed rule for determining independent contractor classification due to the negative impact on workers and business, the test’s lack of clarity and the devastating consequences for the U.S. economy. They are joined by Sens. Hagerty, Romney, T. Scott, Cramer, Johnson, Barrasso, Cassidy, Lankford, Marshall, Hoeven, Blackburn, Boozman, Tuberville, Young, Lummis, Lee, R. Scott, Inhofe, Graham, Fischer, Ernst, Shelby, and Rounds as well as Reps. Wilson, Thompson, Walberg, Grothman, Stefanik, Allen, Banks, Comer, Fulcher, Keller, Miller-Meeks, Owens, Good, McClain, Harshbarger, Miller, Spartz, Fitzgerald, Steel, and Pete Sessions.

Op-ed: FTC on the Gig Economy: The Glass is Almost Empty

October 12, 2022 // The FTC does, of course, have a legitimate role to play in challenging unfair methods of competition and unfair acts or practices that undermine consumer welfare wherever they arise, including in the gig economy. But it does a disservice by focusing merely on supposed negative aspects of the gig economy and conjuring up a gig-specific “parade of horribles” worthy of close commission scrutiny and enforcement action. Many of the “horribles” cited may not even be “bads,” and many of them are, in any event, beyond the proper legal scope of FTC inquiry. There are other federal agencies (for example, the National Labor Relations Board) whose statutes may prove applicable to certain problems noted in the gig statement. In other cases, statutory changes may be required to address certain problems noted in the statement (assuming they actually are problems). The FTC, and its fellow enforcement agencies, should keep in mind, of course, that they are not Congress, and wishing for legal authority to deal with problems does not create it (something the federal judiciary fully understands). In short, the negative atmospherics that permeate the gig statement are unnecessary and counterproductive; if anything, they are likely to convince at least some judges that the FTC is not the dispassionate finder of fact and enforcer of law that it claims to be. In particular, the judiciary is unlikely to be impressed by the FTC’s apparent effort to insert itself into questions that lie far beyond its statutory mandate.

Rideshare, retailers brace for tough U.S. independent contractor rule

September 28, 2022 // The meetings at the White House were one-sided, with officials at OIRA letting groups speak and not participating or asking follow-up questions, several employer sources said. They are interpreting that as a sign the Biden administration's mind is made up. Some of the groups have been trying, and failing, to convince the White House that any broad rule would hurt workers who want to remain independent and have flexibility...More than one-third of U.S. workers, or nearly 60 million people, performed some sort of freelance work.

Surging Support For Union Work? Workers Seek Out Freelance Options More

September 7, 2022 // The same survey found a majority of non-unionized workers have no intention of joining a union, despite their alleged touted benefits. 58% of non-union respondents said they’re “not interested at all” in joining a union, compared to 11% that said they’re “extremely interested.” Moreover, the survey also found that union workers (27%) are “less engaged” in the workplace compared to their non-unionized counterparts (33%).

This Labor Day, let’s ensure that individual workers are empowered, too

September 3, 2022 // Unions should be accountable to their members and remain so. Congress should make right to work laws the standard nationally. It should require unions to make their finances public and periodically hold re-certification votes to ensure they retain their members’ support and transparent elections for leadership. If a union and the workers it represents are in harmony, then none of these reforms will hamper the union—and may even help it. They only become a factor if those same workers want to hold their union accountable. Who has a problem with that?

U.S. Supreme Court won’t hear freelancers’ challenge to California employment law

June 29, 2022 // In 2020, California voters approved a ballot referendum exempting app-based transportation services such as Uber Technologies Inc and Lyft Inc from the scope of AB5. A state judge last year struck down the measure, saying it violated the state's workers' compensation law. An industry group's appeal is pending. The ASJA in its 2019 lawsuit claimed AB5 unreasonably blocks many freelance writers from being treated as independent contractors based on the content of their speech, while exempting similar work performed for marketing or artistic purposes. Samuel Siegel, California Department of Justice