Posts tagged self-employed

Op-Ed: Instead of subsidy fights, Georgia should allow ‘portable’ benefits

October 20, 2025 // Meanwhile, other states have taken the lead on the matter. Utah, Tennessee and Alabama have all formally recognized portable benefits as a form of independent contractor compensation. Georgia can be next by passing a safe harbor portable benefits model, which will cost the state and federal government zero taxpayer dollars. It simply clarifies that companies can contribute to portable benefits accounts if they want and doing so is not evidence of an employee/employer relationship.

COMMENTARY: If Mamdani Wins, the Gig (Work) Is Up

October 3, 2025 // California shows the answer. In 2019, California passed a law attacking independent work. The state’s many photographers, freelance writers, translators, and designers quickly discovered that their once-lucrative work had dried up. Company after company cut jobs. The Mercatus Center found that one out of 10 self-employed jobs disappeared in short order. Even worse job losses were surely on the horizon. Recognizing the danger, California voters almost immediately passed a ballot measure that gave app-based workers and app-based companies the freedom to once again enter into freelance arrangements. The legislature then passed another law to carve out a dozen more professions. But those carve-outs didn’t apply to many other freelancers, like independent truckers, whose ability to work in California remains much more difficult. To this day, because politicians strangled freelance work, Californians have fewer of the jobs they want and need.

Commentary: Unions Are Shrinking Nationwide—But Not in California

September 3, 2025 // California, though, is noteworthy for its steady union presence. It hasn’t fluctuated much since 2005, despite the national decline. Further, the federal data set used to produce the union figures does not include home health care and child care workers who are classified as self-employed. In California, that takes in some 700,000 workers, even though their hourly wages are negotiated with individual counties through unions.

Proposed NJ regulations would impact up to 1.7 million self-employed workers

August 5, 2025 // Director of Independent Women’s Center for Economic Opportunity Patrice Onwuka told The Center Square that “New Jersey is proposing to alter its employment test that determines whether a worker is an employee or an independent contractor.” Onwuka said that “instead of greater clarity, simplicity, and certainty, the NJ Department of Labor is introducing new uncertainty, confusion, and complexity” with this ABC test. The ABC test would go from three one-sentence factors that must be met to prove independent contractor status to three factors each burdened by numerous sub-factors or, as shown in an Independent Women news release.

Federal and State Leaders Take Aim at Empowering America’s Flexible Workforce

July 16, 2025 // However, while federal leaders build support for national reforms to help workers all across America, states are not sitting idle. They know that not only do self-employed workers support greater access to portable benefits, but their residents in general think this warrants policy reforms as well. Instead, many are forging ahead with legal pathways for flexible, portable benefits, maximizing what they can do at the state level in ways that will be further enhanced by federal reforms when they occur. Many states introduced legislation this year to legalize voluntary benefits, but several pioneering states now have laws enacted.

Federal lawsuit alleges discrimination against Vietnamese women nail techs

June 3, 2025 // Licensed barbers, cosmetologists, estheticians and electrologists can still work as independent contractors under state labor law without being subjected to a rigorous test. But exemptions under Assembly Bill 5 expired this year for manicurists. The change has left manicurists and nail salon owners alike confused as to whether non-employees can continue renting booths for their businesses — a decades-long industry practice.

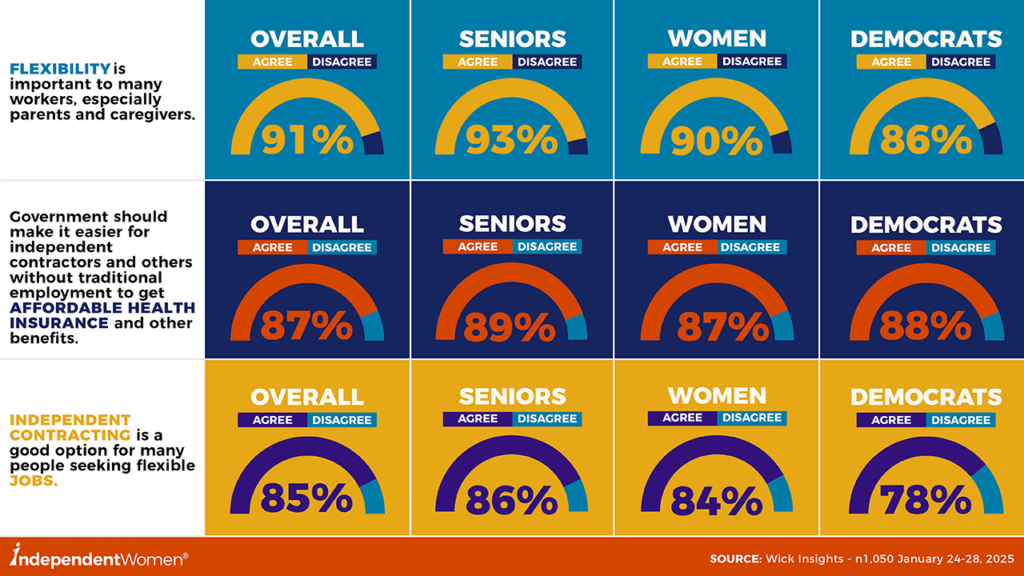

Independent Women’s Forum Survey: 82% of Women Say Government Should Not Force Them into 9-to-5 Jobs

May 6, 2025 // New Poll: 82% of Women Say Government Should Not Force Them into 9-to-5 Jobs Women, seniors, and overall voters almost universally say flexibility is important to them. The vast majority of Americans do not want the government to force people to work 9-to-5 jobs. Women, seniors, and overall voters almost universally say flexibility is important to them. Women and seniors support reforms that could expand benefits to independent contractors without risking their independent status.

Déjà Vu All Over Again

April 14, 2025 // Reclassification attempts began with a media narrative, then blue-state legislation. The same thing is happening now with sectoral organizing.

The Next Wave Commentary: Kim Kavin

March 4, 2025 // In the wave of freelance busting that started with California’s Assembly Bill 5, the method of attack was the reclassification of independent contractors as employees. That method created massive backlash everywhere it was tried, so now, a new method is being tried. That new method is called sectoral organizing. This strategy of freelance busting in multiple states is usually a setup for a nationwide attack against us all. Independent contractors nationwide just learned this the hard way, with California’s Assembly Bill 5 ultimately leading to the introduction of the federal Protecting the Right to Organize Act. The freelance-busting brigade is, once again, doing a test run of its idea in the states, with bigger ambitions on the horizon.

Bills Introduced in Congress Work to Secure the Right to Work for Independent Professionals

February 27, 2025 // On February 13, California Congressman Kevin Kiley (R) introduced two bills in the House of Representatives that seek to codify and protect independent professionals and contractors. In this 119th Congress, Paul has partnered with two key right-to-work organizations to reintroduce “The National Right to Work Act”: The Institute for the American Worker, and the National Right to Work Foundation.